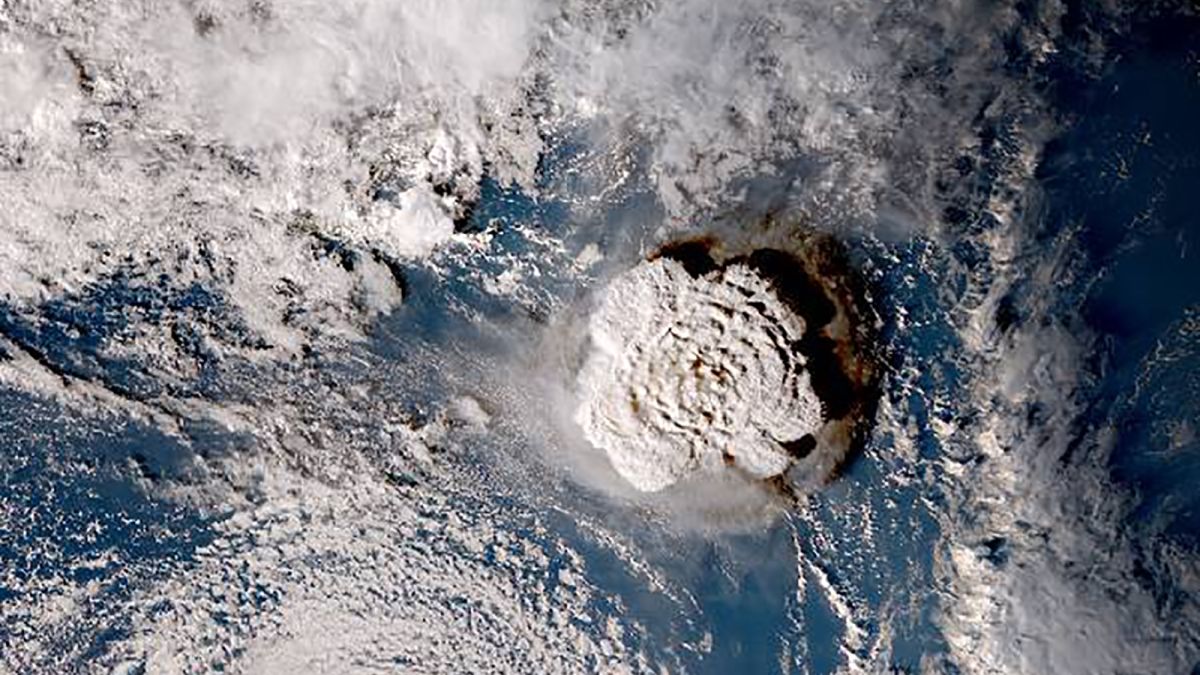

The “volcanic ash” of the war launched by Russia can affect many other countries

After being hit by the pandemic, the world economy and the economy of the countries that are trade partners with Albania fell prey to inflation, where the price jumps generated by this economic situation are directly affecting the Albanian market on an even larger scale than in the countries that supply most of the products we consume.

With the beginning of the Russian invasion of Ukraine at the end of February 2022, the European and world economies are entering another downward trajectory of the financial markets and with an unpredictable direction of economic developments according to the plans they have made for 2022 and in continuation.

From the moment Russia took on the role of occupier the economic effects are already influenced by politics. It seems that this year will continue to affect the global economy through military and political force. This can be seen from yesterday when the direct reactions from the EU countries started, as well as the G7 where it was stated that they will apply extraordinary financial, economic and trade restrictions for Russia, but with influence also in those countries.

These restrictions that will be implemented by most powerful governments of Europe and small ones find Russia’s trade relations with major European countries in a situation of interdependence on energy products with considerable impact on households and industries. Europe gets almost 40 percent of its natural gas and 25 percent of its oil from Russia and is likely to be supplied with rising heat and gas bills from the beginning of March, which are already rising even without this. war situation started by Russia towards the eastern gates of Europe. Natural gas reserves are at less than a third of capacity, and with even weeks of cold weather ahead, the trade relationship between Russia and the EU will move into a forced stalemate for already political reasons.

This war started by Russia will further aggravate Turkiye, which is in the middle of an economic crisis and is struggling with inflation that is going close to 50 percent, with rising food, fuel and electricity prices. on the other hand, Russia itself seems to lose equally or even more from the restriction to the cessation of gas and oil exports to these destinations[1].

Given this broken global trade relationship to make way for a new one, military spending, like other forms of government spending, seems to be an important source of economic demand at a time when Russian citizens are at a low ebb. trust in the government (only 37% of citizens trust the government)[2], but also sensitive in their income to the economic downturn.

Global markets are already worried and are heading for a decline though not very big at the moment. Part of the reason is that “markets tend not to be equally affected by extreme events, especially when they are of a military nature” – says Paul Donovan, chief economist at Swiss bank UBS.[3]

Meanwhile, given the initial developments of war effects, it seems that the markets still perceive that the economic consequences of the conflict will be limited to the region, with a major impact in Ukraine and a significant consequence in Russia, due not only to sanctions. The real and influential risk for the economies that will implement the sanctions is that, to reach the level of severity of the restrictions declared by the US and Europe, the sanctions will also cause pain in themselves. This is already expected to happen after the two main sanctions, which are (a) the boycott of Russian gas flowing into Europe, with the indefinite postponement of the Nord Stream 2 pipeline, crucial for Moscow, and (b) the removal of Russia from the message network SWIFT[4] used by 11,000 banks worldwide for fast and secure money transfers. Russia’s exclusion from the SWIFT system of intra-bank messaging also risks producing unwanted effects. Russian banks will be largely detached from international transactions, and certain industries will suffer from export bans on important high-tech components and goods that are difficult to replace by domestic production or imports from China.

Maria Shagina, an associate at the Zurich-based Center for Eastern European Studies, said such a move would be “devastating, especially in the short term”. This would cause currency instability and massive capital outflows.

Russia can mitigate the effects because it has developed a financial messaging system in recent years trying to mimic SWIFT. But it is still imperfect and used mainly by Russian banks. Further devaluation of the ruble would increase inflationary pressures, reduce the real disposable income of households and negatively affect trade conditions. The central bank would react with higher interest rates to protect the ruble, but this would further aggravate economic growth. In this scenario, Russia will have to impose a large part of the fiscal and external constraints it has built in order to maintain macro-financial stability.

There is no doubt that sanctions will hit the Russian economy hard. In the last seven years it has been seen that measures to limit economic ties and financial flows between the rest of the world and Russia have come at a heavy price for the Russian economy and wealthy individuals. Anders Åslund and Maria Snegovaya, two economists at the center of the Atlantic Council’s Eurasia, have shown that sanctions imposed after the annexation of Crimea and the start of the Ukrainian conflict in 2014 may have reduced growth since then by 2.5% to 3% a year.

Sanctions will continue to be an obstacle to the growth of the Russian economy, but with long-term consequences. Russia’s growth model in the last decade has been characterized by low private investment, with a sick fiscal system even before it was hit by sanctions. But sanctions have already made things worse in increasing progression, and the war that has already begun is one of the reasons stemming from the economy and the fiscal system.

In the event that Nord Stream 2 will not function as long as the military and political situation stabilizes, Putin may double down and decide to cut or reduce gas shipments to Europe as a form of counter-sanction. This impact on gas prices will force European markets to increase demand for oil and energy, directly affecting Albanian imports. This would be one of the direct impacts on the Albanian economy, as well as on all other countries. But based on the specifics, when our country is an oil producer, a negotiation with the producers would be very valuable to enable a reduction of the oil cost by using it as a raw material to be processed for the Albanian market in one of the countries neighbors’ refineries. This would be a solution in the conditions when the Albanian oil and gas producers themselves have a contractual obligation to hand over a part of the production.

The consequences for the Albanian economy that would come from the conflict in Ukraine do not have much direct impact on trade relations between the two countries but also with Russia, because the trade volume in 2021 seems to be somewhere between 1% – 2% of total imports and Albanian exports.

But, beyond the impact on Albania’s trading partners, mainly for fuel and electricity, it seems that it will have an effect on the budget forecasts to be made regarding policies dictated by the relocation of citizens to countries outside the conflict. Although Albania is far from the borders of Ukraine and will probably not be hospitable to potential refugees from Ukraine an effect that needs to be recalculated is related to the tourism industry. Given the influx of tourists in recent years from Eastern European countries, Russia and countries in the surrounding area a protracted conflict in time could restrict their movements given the deteriorating financial stability. However, the situation seems to be changing, as the war beyond all requires large expenditures, which in any form will be reduced due to the blockade of all developed countries.

The precedent set by the Russian attack must once again be carefully considered the situation of Albanian emergencies, as well as the defense budget within modesty to better understand how to use it in these times when appetites to show strength can appear in many mini hotbeds of war even in other countries where past conflicts are currently latent.

In conclusion, it can be said that the “volcano ash” of the war started by Russia can and will affect many other countries. is not secondary but influential throughout the energy and food supply chain. Russia as a major producer of oil and natural gas, is increasing concern and uncertainty worldwide, but as the world’s largest exporter of grain and supplies major foodstuffs in Europe will be equally influential in the food industry.

Why is it having such a huge impact on the economy?

First, Russia produces 10 million barrels of oil per day, roughly 10 percent of global demand, and is Europe’s largest supplier of natural gas, which is used to fuel power plants and provide heating for homes and businesses. As labor stock markets fell, oil prices rose to around $ 6 a barrel. Second, it’s enough to read excerpts from US President Joe Biden’s speech yesterday[5] to understand that “… we’re taking active steps to bring down the costs. And American oil and gas companies should not — should not exploit this moment to hike their prices to raise profits. You know, in our sanctions package, we specifically designed to allow energy payments to continue. … I know this is hard and that Americans are already hurting. I will do everything in my power to limit the pain the American people are feeling at the gas pump. This is critical to me.”

While it is possible that the outcome of the current crisis will mean further destabilization of Ukraine as a whole, economically, politically and socially, the biggest problems will come from not finding a compromise between Ukraine and Russia on the one hand, but also G7 countries and beyond and Russia on the other hand, for reasons that are clearly understood in the speech of Russian President Vladimir Putin before the start of the large-scale attack on Ukraine.

Without underestimating Russia’s influential role, it is clear that many of the difficulties Ukraine faces in achieving sustainable economic, institutional, and governance development also stem from other domestic sources[6].

Should the conflict subside in the region, a peaceful transition to democracy will affect economic growth by encouraging investment, education, economic reforms, securing public goods, and reducing social unrest.

[1] according to the Central Bank, Russia’s total exports in 2021 amounted to $ 489.8 billion. Of this, crude oil was $ 110.2 billion, petroleum products $ 68.7 billion, piped natural gas $ 54.2 billion and liquefied natural gas $ 7.6 billion.

[2] https://www.statista.com/chart/12634/where-trust-in-government-is-highest-and-lowest/

[3] The assassination of Archduke Franz Ferdinand of Austria in 1914, which caused the chain of events that led to the First World War, was ignored by the markets of that time – notes Donovan

[4] Swift is the global financial artery that allows smooth and fast transfer of money across borders. He stands for the Interbank Financial Telecommunication Company worldwide. Founded in 1973 and based in Belgium, Swift connects 11,000 banks and institutions in more than 200 countries

[5] https://www.whitehouse.gov/briefing-room/speeches-remarks/2022/02/24/remarks-by-president-biden-on-russias-unprovoked-and-unjustified-attack-on-ukraine/

[6] https://wiiw.ac.at/possible-russian-invasion-of-ukraine-scenarios-for-sanctions-and-likely-economic-impact-on-russia-ukraine-and-the-eu-dlp-6044.pdf