The 2026 budget is fundamentally oriented toward capital investments, which make up around 33.8% of total expenditures, with a primary focus on infrastructure and defense.

From a business perspective, this opens medium-term opportunities in construction, transport, and energy.For citizens and social groups, it translates into social stability and improved services: pensions and healthcare remain priorities, while several ambitious political objectives, such as large-scale digitalization, the construction of 1,000 school laboratories, and increasing pensions to €400/€200 are not fully covered by the 2026 capital lines.

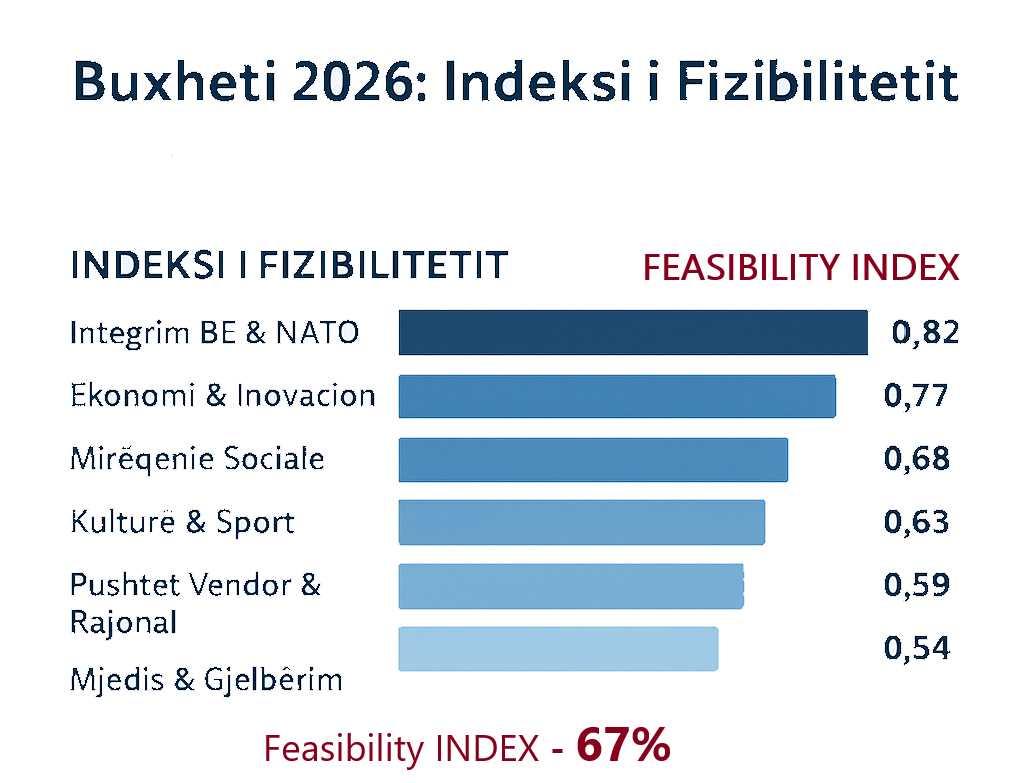

The Feasibility Index, calculated based on the alignment between budgetary resources and sectoral objectives, stands at 0.67 (67%).

This level indicates that more than half of program objectives are financially supported and realistically implementable, but a significant part (≈33%) remains uncovered or dependent on external factors such as EU funding, legal reforms, or private partnerships.The lowest-feasibility pillars are environment, local governance, and justice/administration digitalization.

Conversely, EU/NATO integration and economy/innovation show higher feasibility scores, reflecting clearer priorities and resource allocations.

1. Business Perspective

Infrastructure investments and the Albanian Development Fund create a relatively favorable environment for traditional sectors such as construction, energy, and water supply, offering a solid base for economic activity and employment growth. These capital lines enable major infrastructure projects that produce a multiplier effect across the real economy, stimulating activity in supply chains and supporting industries.

However, the lack of dedicated funding for R&D and innovation negatively affects the development of the technology sector and start-ups.

Without sustainable financial support for research and development, the segments of industry reliant on technology and value-added production risk stagnation, limiting the economy’s transition toward a more advanced and internationally competitive model.

Another challenge is the reliance on foreign financing, which accounts for about 25% of capital investments.

This dependence increases the risk of delays in project implementation and creates liquidity concerns for companies, especially those lacking stable internal financial flows.

In the medium term, the 2026 budget offers concrete opportunities for traditional economic activity, supporting the development of infrastructure, energy, and public services. However, the transition toward a knowledge-based and innovation-driven economy remains constrained due to the absence of dedicated financial instruments and policies to de-risk private investments. Without such measures, the ambitious objectives for developing the technology and start-up sectors risk remaining aspirational, without translating into genuine gains in productivity and competitiveness.

2. Government Perspective

The government appears oriented toward a careful balance between macroeconomic stability and capital investments, with particular emphasis on infrastructure, defense, and social services. This approach reflects a conservative stance aimed at maintaining fiscal discipline and ensuring efficient use of public funds while addressing the population’s core needs.

A major challenge remains the implementation of high capital expenditures, especially regarding ambitious commitments in the governing program, such as the digitalization of the pension system, school laboratories, and innovative public-service investments. The absence of dedicated capital lines for these projects may hinder their execution and raises the risk of delays or partial implementation.

In this context, inter-ministerial coordination and administrative capacity are decisive for successful execution.

Without clear coordination mechanisms and strengthened executive capacity, the potential of capital investments may not be fully realized, reducing their effectiveness and expected social impact.

Fiscal-realism analysis suggests that the budget is sound in macro-fiscal terms, but alignment with the more ambitious political goals remains moderate.

To improve efficiency and avoid gaps in sectors with significant commitments, the government must focus on clear implementation instruments, capital lines directly linked to objectives, and continuous monitoring ensuring that real resources translate into concrete results.

3. Citizen and Social Perspective

The 2026 budget maintains social services as a key priority, ensuring stable coverage for pensions and healthcare. This provides a safety net for citizens, protecting the most vulnerable groups and sustaining basic social stability.

However, education and youth-oriented programs, such as school laboratories and the Youth Guarantee remain limited due to insufficient capital funding. This shows that while the social baseline is protected, new strategic objectives aimed at improving youth opportunities and human capital development may be difficult to achieve without additional resources.

The more ambitious components of the social program, such as pension increases and large youth-investment initiatives, fall only partially within the 2026 financial coverage. Without a clear strategy for revenue growth or mobilization of alternative financing sources (e.g., private funds, PPPs, international grants), these commitments may remain mostly on paper, limiting their real-life impact.

Therefore, the social effectiveness of the budget depends not only on the amount of allocated funds but also on the capacity to channel these funds into strategic projects that directly benefit citizens and vulnerable groups.

4. Macroeconomic and Development Perspective

High capital expenditures and infrastructure-focused spending are expected to stimulate employment and economic activity, amplifying multiplier effects in key sectors such as construction, transport, and energy. This approach supports macroeconomic stability and drives traditional economic growth.

Yet, knowledge-driven economic sectors, R&D, innovation, and high value-added production receive insufficient support. This limits Albania’s potential to shift from traditional growth toward a more innovative and sustainable development model.

Dependence on foreign financing and limited administrative capacity for utilizing EU funds further increases the risk of delays, inefficiencies, and medium-term growth vulnerabilities.

Dedicated policies for innovation and strategic sectors are necessary, as the developmental impact of the budget may remain constrained and unable to fully leverage the potential created by high infrastructure investment.

5. EU Integration and NATO Commitments

Capital investments and increased defense spending align with NATO expectations, reflecting a clear orientation toward strengthening national security capacities and fulfilling international commitments. Infrastructure and e-governance digitalization projects partially meet EU requirements, showing commitment to the integration path but also highlighting persistent gaps.

The lack of funding for critical acquis chapters, such as justice and public administration slows integration progress and underscores the need for specific capital investments to accelerate alignment.While the 2026 budget demonstrates considerable compliance with international standards in defense and infrastructure, full alignment with EU objectives requires stronger capital lines for digitalization, rule of law, and administrative reform.

Feasibility Index of the 2026 Budget

The 2026 Feasibility Index stands at 0.67 (67%), serving as a critical indicator of the budget’s implementability relative to political and social objectives. This result shows that while most goals are financially supported and achievable, a significant portion remains dependent on external factors such as EU funds, legal reforms, or private partnerships.

Sectoral Analysis and Reasons for Feasibility Scores

• Integration/NATO – 0.82. Strong prioritization and substantial financial support, with clear capital lines aligned with alliance standards. High feasibility reflects political priority and adequate resource allocation.

• Economy & Innovation – 0.77. Infrastructure investments are well-covered, sustaining traditional economic activity. However, R&D and start-ups remain underfunded due to the lack of dedicated financial instruments, limiting the potential transition to a knowledge-based economy.

• Social Welfare – 0.68. The budget covers core social services such as pensions and healthcare. However, new objectives, like pension increases, youth programs, and school laboratories require additional funding not fully present in the 2026 capital structure.

• Environment & Green Transition – 0.54. Capital lines remain insufficient for ecological and urban projects. Many environmental projects depend on external grants or private partnerships, lowering feasibility.

• Culture & Sports – 0.63. Partial coverage due to lower budget priority. Small projects are possible, but major or innovative investments are unattainable without new resources.

• Local Government & Regional Development – 0.59. The low index reflects limited administrative capacity and insufficient capital lines.

Regional projects often face bureaucratic hurdles, limiting their impact.

The overall index of 67% indicates medium-level feasibility. More than half of the objectives are covered by existing resources, while around one-third of the program remains uncovered or dependent on measures outside the budget. This gives readers a clear picture of what is realistically achievable with current resources and what requires revision or additional funding.

The 2026 budget represents a significant instrument for macroeconomic stability and infrastructure-driven growth, supporting traditional economic activity and several core social objectives.

Capital investments, particularly in infrastructure, defense, and social services establish a stable foundation for implementing key priorities of the 2025–2029 governing program.

However, the Feasibility Index (0.67) indicates that around one-third of program objectives remain outside current resource coverage. This reflects a mismatch between ambition and available financial and administrative capacity.

The most affected sectors include digitalization, R&D, youth innovation initiatives, and environmental/urban development projects that rely partly on external funding.

The analysis shows a clear trend toward focusing on projects with immediate economic impact, while medium-term transformation toward a knowledge economy and innovation remains limited. Without dedicated financial instruments and mechanisms to de-risk private investment, the full realization of the 2025–2029 vision for innovation, digital transformation, and strategic sector development remains challenging.

To fully meet program objectives, several key steps are necessary:

• Reallocation of capital lines toward strategic sectors and underfunded priorities• Strengthening administrative capacity and intersectoral coordination to ensure effective implementation

• Developing alternative financing strategies, sucha as PPPs, EU grants, private investment to fill funding gaps

In clear terms, the 2026 budget is feasible and sustainable for traditional objectives but less aligned with innovative and transformative ambitions. This underscores the need for more strategic planning and additional resource mobilization to guarantee the fulfillment of the 2025–2029 vision.